MARA Chairman and CEO Fred Thiel participated in a fireside chat with premier global independent investment banking advisory firm, Evercore ISI.

Transcripts are autogenerated. May contain typos.

well very good morning everyone and welcome to today's fireside chat with Fred the the CEO at Marathon digital uh I'm James West as most of you know I run the sustainable Technologies and clean energy team here for evercore isi Marathon digital Holdings is digital asset technology company which engages in mining cryptocurrencies uh with a focus on blockchain on the blockchain excuse me ecosystem and the generation of digital assets company was founded in 2010 and is headquartered in Las Vegas Nevada Brett Theo is the CEO he is a

respected expert and frequent speaker on fintech digital assets blockchain Bitcoin crypto mining uh The Internet of Things artificial intelligence vure Capital private equity and of course the digital transformations of companies and industries and provides deep technology industry expertise and strategic advice on transformational value creation it has over 30 years of operating experience leading companies in the cryptocurrency digital assets semiconductor data Communications uh and other Industries FR attended uh the

Stockholm School of Economics executive class at haror business school and is fluent in English Spanish Swedish and uh French uh so three of those are not fluent in so congratulations Fred but Fred thanks for thanks for joining us today I appreciate having you on glad to be here so um those of you listening in the Laine uh if you have questions please do put your questions into the uh Q&A box and I'll make sure to get them over to Fred obviously I have plenty of questions that I'll I'll be asking

myself but uh we always want to make these things uh these things interactive so maybe Fred if if you could start uh could you share with us the origin story of marathon digital and the company's your mission goals and priorities sure so um coincidentally Marathon actually started as an actual mineral Mining Company uh mining vadium and uh like many companies that whose Origins are in the micro Cap World um they failed at that then they were in the oil and gas industry for a little while so some energy background and then um they did a

company did a brief stint in real estate all the while kind of changing kind of ownership and control groups and then um went into the patent space and became a patent Troll and was formerly known as Marathon patent group Marathon patent group um had uh one claim to fame really which is uh it owns still to this day uh the under one of the underlying patents for Siri and Alexa so the you know a voice control of a mobile electronic device uh through a limited instruction set and um Apple paid a hefty license fee to Marathon after some litigation

and then Marathon spent all that money trying to litigate um Amazon and to this day that case is still open and pending but um Marathon uh as you know it today doesn't spend any money on that at all that's done Fortress Investments took over that patent and they're busy um they're IP litigation arm is busy doing that um so that's kind of the history in 2017 um a uh group uh Marathon patent group had essentially um run out of money raised some financing through some uh sort of uh less advantageous notes

and a group took over control of the board they had decided they wanted to go into the crypto space and they hired a gentleman by the name of amamoto to kind of recast the uh cap table uh fix the finances and get it into the Bitcoin mining space and I had known Merck for about 20 years I had been I've been in tech for 40 years and uh did a detour into private equity and Venture Capital but had been spending the period around 2015 to 2017 in the crypto space specifically around Bitcoin and he asked me to join the board to see if we could

figure out how to make Marathon a valuable company and in 28 early 2018 I joined the board and then we set about on the course of figuring out how to get into the Bitcoin mining business raise capital and grow the company and um from very humble beginnings of buying secondhand Miners and plugging them in in Quebec Canada uh to being the largest Miner in the world across three continents with 11 sites um and growing at a very rapid rate uh we kind of figured it out you could say uh and uh you know in 2023 we uh essentially grew 3x

over where we were in 2022 uh this year we'll grow another 2x over where we were last year and um continue to be the largest minor in the world uh then also we we have since kind of evolved our mission and vision so we really look at ourselves as a company that focuses on um leveraging the um neus of energy and compute so if you think about this is something that Scott Galloway the marketing uh professor at NYU Stern talks a lot about um in the 80s and 90s really 70s 80s uh energy companies were the most valuable by

market cap uh on the uh stock markets and then in the 90s and early thousands technology companies took over that kind of mantle and today with the Advent of AI and digital asset compute you now have this Confluence of energy and compute coming together to form what will be some of the most valuable companies out there we believe and so we are essentially a company that leverages energy uh to secure the digital asset markets uh the Bitcoin blockchain is essentially secured by the process of people deploying compute power and using

lots of energy and that's what helps secure it um and happy to go in more depth and explain that later um but what we also realized was that uh we also serve the energy markets very efficiently so Bitcoin miners at scale can go in and work with utilities to balance grids so if you think about the electrical markets electricity demand goes up and down like this all day long right a sma

ll Peak at 9:00 a.m. then there's a dip around midday and then it grows slowly through the afternoon until between kind of 3:00 and 9:00 p.m. there's another Peak well the electrical grids need to balance Supply to demand because the electrical grid is like Plumbing you can't put more electricity into it than it's being taken out or else the pipe's burst and so the grids need somebody who can help balance that load and typically they do that by adding more capacity as needed uh so Battery Systems uh peer plants but those

all make money by charging premium prices for their energy on the other hand Bitcoin miners like us at utility scale as we call it we can be buying 250 megawatts 100 megawatts large load as base load meaning we consume it all day long and whenever the grid needs it we can do one thing no other industry can do and that is we can shut off our systems in 10 minutes or less and all of a sudden all that energy is available to the grid without it costing the Grid or the consumer single penny extra whereas batteries and peer plants cause the

price of electricity to go up and to give you an idea of the difference in price where we're maybe buying energy in the kind of $30 to $40 a megawatt range a peer plant is selling energy at $5,000 a megawatt so it has a huge impact on consumers so that's utility scale mining then we realized that there is a lot of wasted or stranded energy out there that isn't being used that could be used for digital asset compute and more importantly could be used to bring positive um uh environmental uh benefits

to Bear such as mitigating methane so we today in Utah for example leverage methane gas coming out of a landfill we generate electricity from it and we mine Bitcoin using it now what's the benefit of that well twofold one is methane is 80 times more damaging to the environment than carbon dioxide and so we're turning something 80 times worse than carbon dioxide into carbon dioxide so therefore mitigating huge environmental impact but more importantly doing that lowers our cost to do what we do so it actually has an

economic benefit for us and it can lower our cost by upwards of 50 or 60% which can make us one of the most energy efficient Bitcoin miners in the industry over time as we grow that business the other thing we can do is take methane flared at oil fields capture that energy use that to mine Bitcoin and then there's something really interesting we can take biomass so think everything from manure at dairies to the leftover products from ethanol and methanol manufacturing and everything in between we can put those into what are called

anerobic digestors which essentially takes it adds a bacteria turns that into energy we use that energy and here's a really fun fact 50% of all the energy consumed by industry is used for generating Heat what we can do is because our Electronics generate heat we can capture that heat and feed it back into an industrial process so if you think about ethanol manufacturing beer brewing all sorts of things they need to heat the substance they're using to make their product and so if we can take the waste product

generate energy from it and then feed heat back into their process we allow them to not have to buy the energy to heat their process and they don't have to pay somebody to process the waste product and so essentially our cost of energy becomes zero and that means again that we can do what we do for the Bitcoin blockchain at almost a net zero cost eventually as these programs continue to grow and become a bigger portion of our business and the last part of what we do is we're fully vertically integrated from a

technology perspective just similar to Apple we have everything from our Cloud software down to the the as6 that the application specific integrated circuits the chips if you would that um run Miners and so we have the ability to do things with that technology stack that other people can't do we have some of the most advanced liquid cooling technology which allows us to do two things it lets us operate our systems um and totally ignore the the um climate environment we're in so for example we operate in uh the Gulf region in the

Middle East in UAE where the average temperature is 110 de in the ambient uh with 95% humidity and we essentially take our miners and we put them into a liquid that cools them not water so we're not wasting water this is a closed loot process and we can run these machines all day long no matter how hot it is outside and then we can capture that heat and use it for something uh our technology is equally as applicable in the AI space which is by far one of the most rapidly growing Industries today to cool infrastructure for data

centers so we believe we have this very um Diversified model where we're leveraging energy to stabilize grids meanwhile producing Bitcoin and St and securing the Bitcoin blockchain we're harvesting stranded energy and using it to generate heat which we can resell back into companies while generating Bitcoin and securing the Bitcoin blockchain and then we have technology that allows people in the Bitcoin mining space to do what they do in a better way while at the same time also opening us up to the benefits of the rapid growth

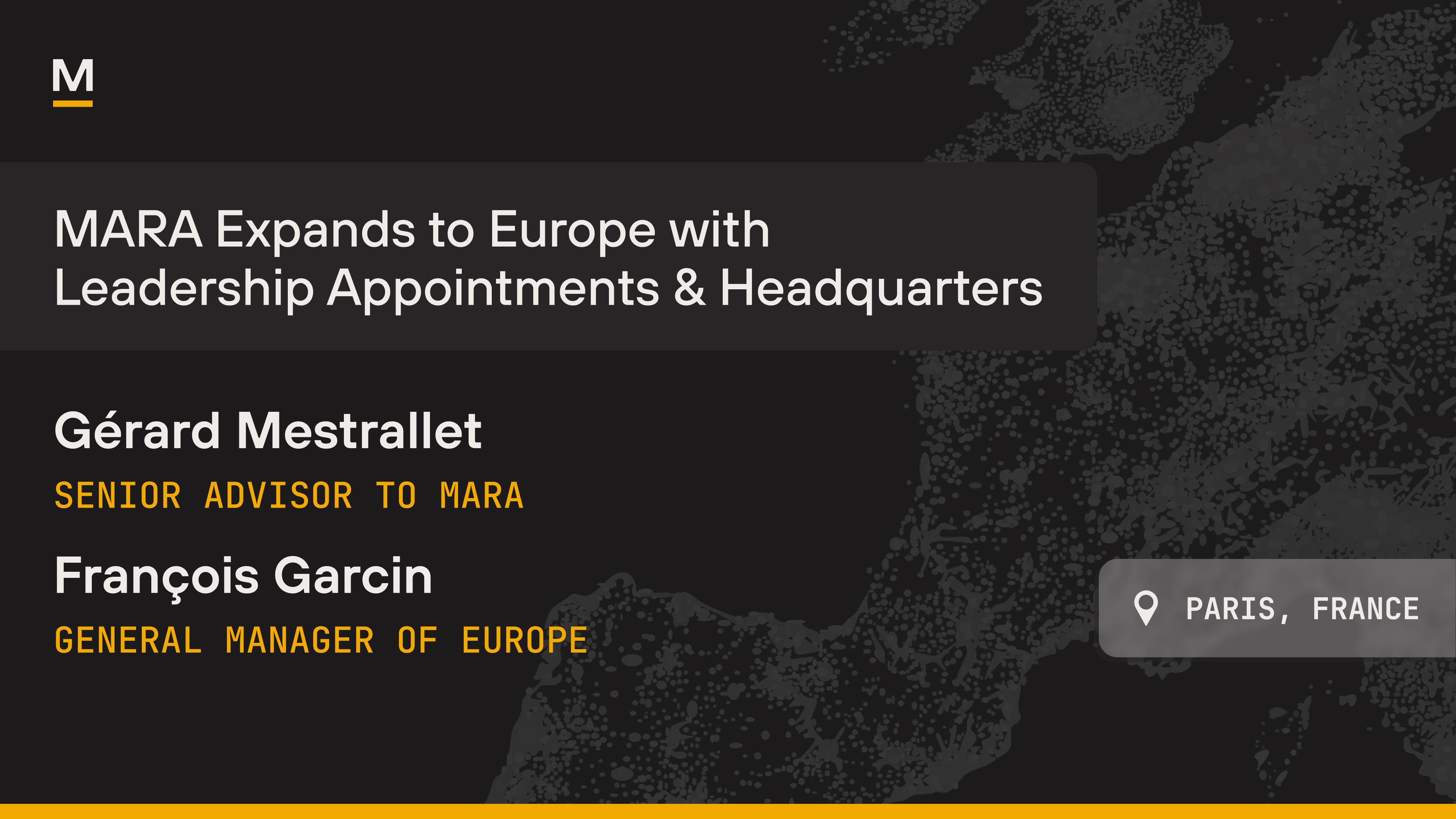

in the AI industry and potentially in the Telecom industry around infrastructure cooling so we believe it's a very Diversified business again we operate on three continents 11 sites so we have good diversification from a location perspective and our expectations are by 2028 we'll have about 50% of our revenues International versus domestic and about 50% of our revenues will come from things other than just traditional digital asset computes such as energy trading Etc that's fascinating and not something

I think many people understand about Bitcoin mining and how that the intersection of Nexus with energy uh comes about one of the things one of the terms that that came up a lot is that was doing some work on on your company and maybe to help us start more detailed conversation um can you help us understand what the energized hash rate metric is and I know you recently increased your 24 hash rate target to 50 xash and so I guess can share with us what drove that decision too sure so if you think about the oil industry you

talk about how many barrels per day you can produce well ex aash is a measure of compute power and for those of the audience who have been familiar with kind of the cloud computing world you talk about things like teraflop and Giga flops um uh and so um ex aash is the equivalent of a million Tera hashes and a hash is essentially a calculation and so we can do if you say One X a hash that means 1 million trillion so a million trillion calculations a second and so we today operate about 30X a hash so we do 30 million trillion

calculations a second in our data centers across the world and it's you could think of it as just a measure of horsepower production capacity is really what it is and we look at the industry in the Bitcoin world there's a total Global hash rate which is what happens if you sum all of the hash rates of all the companies together you get a total number we represent today somewhere between four and 5% of the global hash rate in the Bitcoin world and grow we're one of the few miners who is able to grow their share of the global hash rate

because the global hash rate's growing annually as more people get involved in this industry and people grow and most people can only grow at the rate the industry grows but we're able to grow faster than that because of our model uh and how we essentially Source sites and deploy capital okay okay got it makes sense and then could you talk about um your software Hardware infrastructure vertically integrated technology strategy and how that differentiates you yeah so uh perfect example is kind of apple versus the uh non-apple mobile

phone World um Apple makes its own chips for its phones they make their own operating system or firmware that runs in the phones they make their own cloud system iCloud where you can subscribe to services and products and that where everything gets backed up and that's what helps operate the phone uh we're very similar than that uh in that we have the ability to use uh as6 by company that we helped co-found called oradine which is the only us manufacturer of these Computing chips for Bitcoin mining uh and that's an

important thing to realize because the vast majority over 90% of the chips today come from China and were we to get into a deeper trade war with China those um participants in the market that depend on the Chinese Chips would be uh at a disadvantage so we started a company uh few years ago together with some of the top Venture capitalists in Silicon Valley and some of the top design teams to build worldclass technology for this space which we've done uh we also make the firmware the operating system that runs in these

Miners and the cloud software that kind of orchestrates what they do on a global basis the benefit to that is that because it's all vertically integrated again think the Apple model it all works more efficiently than uh if you are integrating third-party products in a stack because we don't have to think about or worry about the um all the other possibilities a third-party product has to deal with so if you think about the cloud software or the pool as it's called in the Bitcoin mining World um they have to worry about different

companies accessing so they have a whole security layer that we don't have to have because we're the only customer of our pool we're the only person who uses our pool so we can strip out the overhead of all that security stuff because we're a closed box if you would um then how the miners communicate with the pool again we only use typically one or two machine types in what we do so we can optimize the communication infrastructure we can optimize the uh latencies the way uh timing delays happen to our benefit which you can't do

in a third-party pool system um we can strip out all of the operating overhead in the firmware or software that runs in the miners because we operate so many hundreds of thousands of miners that we can um essentially take away some of the overhead that is natively in Bitcoin miners because they have to be designed to work either in a fleet or by themselves and so we can strip out that excess overhead and all of that does is gain gives us little gains and the best way to see the benefit is um if you were to compare um the transaction fees if you

would which is a a metric I'll talk about in a second which is think of it as how we get paid for what we do um and you compare our fees what we receive versus other miners we earn a higher fee on average per block that we win which is per block that we process um because of this vertical integration we can maximize the value of the fees and we're not paying third parties for each layer of the technology stack uh along the way so it makes us much more efficient so that technology stack makes us more

efficient and also more effective um in what we do okay okay got it that makes a lot of sense and then could you talk a bit about um uh the new I think I think it's the the the two tupi 700 and your plans to transform data centers and Mining operations yeah absolutely so um one of the biggest challenges uh especially in the AI world today is the power consumed by these chips grows and electronics convert energy essentially into heat um and they're very efficient at it unfortunately that heat needs to

be moved away from the chips or or the chips become damaged and traditionally computers and data centers have air conditioning to cool them well the power density in Ai and Bitcoin mining is very similar you have huge amounts of power going through a very small surface area of components and so if you have a very small area that is generating a lot of heat the transfer rate of air uh for moving that heat away is very bad so you have to go to liquid and what a lot of AI systems and um other systems have done has gone to what's called a uh

onchip cooling which is essentially think of it as there's a radiator attached to the chip um that has water flowing through it and that water absorbs the heat away from the chip and moves on uh but we've now reached a point where that's not efficient enough and it doesn't work well enough and so you now have to immerse you have to syn the whole thing the whole computer if you would into liquid such that you can move that heat away and there are two types of liquid immersion there's what's

called single phase and think of that it looks just like a car radiator cooling system right you have water in your radiator in the car the water runs across the cylinders takes the heat away goes to the radiator where there's a fan blowing that cools the water down again and then the water cycles back around the hot parts and it goes around and around in a loop that's singlephase immersion and what phase means is the liquid never changes into vapor it stays in a single phase which is it just stays a liquid the two pick stands for

two-phase immersion and essentially what we do is we enable the liquid to boil so what happens when it boils well it changes into a vapor when it changes into a vapor it takes six times the energy out of the liquid to become a vapor and so it's a huge it has this huge ability to just suck heat out of things and then the vapor condens around a cond condensation coil this is kind of like how alcohol is made you distill it you turn a liquid into a vapor The Vapor then condenses and you collect that liquid so this is a closed loop kind of

process um very unique um aspect of what we do is we have and we've applied for patents for this a very unique way of cooling these condensers and condensing the fluid that makes it very cost efficient and cost effective and so it costs roughly about the same almost to use our two-phase immersion technology as traditional singlephase the big benefit to two-phase is you can pack four times the compute power in the same space and so if you want to build a Data Center and this compute power is getting more and more dense if you just look at

nvidia's product road map they're going from a need of 40 kohs to 80 to 120 to 160 all in the same space we can do that and so we're working with oem's uh original equipment manufacturers in the AI comput space to build Solutions specifically for their needs in the Bitcoin mining space there's a huge need for this and we're already starting to deploy tpck in our own sites uh and we're seeing some great benefits one of the benefits that directly um applies to our bottom line and our capex

requirements is that because of how this technology works we can essentially um take a computer if you would that's designed to produce let's just for easy math say One X a hash because that's the term we've been bandying about and I can run it so it produces I can put more energy through it than it normally would use and I can run it at say 1.

5 ex aash and by doing this in our two-p pick system the Energy Efficiency loss by overclocking as it's called I'm running it at a faster clock rate um is actually di Minimus and so I can get the same amount of ex aash but use less Capital because I now have to buy fewer miners because I can run them at a higher speed without losing a whole lot of efficiency and that means that we become much more Capital efficient as a company and compared to our peers who let's just say are spending one to one on their uh hash rate to their normal

clocking we could spend 30% less and which means we could take that 30% capex savings apply it to even more capacity and grow even faster than we're growing today right okay well you you brought up some Financial metrics and I had a one question from me but then I also had a question come into my my inbox just a minute ago um but what is your strategy in terms of you know your treasury management and then furthermore the question that came in was you know last year you did exchange um your converts your December 26 converts at a 21%

discount your balance sheet is strong but how are you thinking about the 331 remaining convertible debt of the balance sheet yeah so um from a treasury man management perspective we obviously produce this asset called Bitcoin and up until the end of last year Bitcoin was viewed as an intangible asset by fby and so you essentially could only impair it you can never Market to Market um since the beginning of this year the rules have changed so we can now Market to Market and if you look at our q1 results you'd see we generated an adjusted ebit

because of the fair market value calculation that was 2x what our over 2x our revenues uh because the price of Bitcoin appreciated so we believe that Bitcoin appreciates um at somewhere north of 50% a year on average if you look over the past seven years over 153% if you look over the past 13 years annually and so if we look at our weighted average cost of capital it makes sense for us to essentially use the lowest cost capital for growth and um selling our Bitcoin uh we would miss this appreciation in the asset that we have been able to attain

we're the second largest holder of Bitcoin of public companies in the US right behind micro strategy uh well not right behind but there's a big gap but there's nobody else in between I'll put it that way they have about 10 times as much Bitcoin as we do but still so we have over a billion dollars of Bitcoin in our balance sheet um and that impacts how we trade a lot of people view our stock as a perfect proxy to bitcoin and so we have an additional beta in our stock which spot ETF spot Bitcoin uh do

not have uh nor does Micro strategy in that we essentially like uh Warren Buffett does with miners you know our cost to extract Bitcoin remains relatively constant compared to the uh price increase of the commodity itself and so you get the benefit of essentially by owning marathon of buying Bitcoin at a discount that's kind of how you can look at it and so you see our stock trades typically um with a beta to the price of Bitcoin when Bitcoin goes up one or two percent we go up three or 4 percent when Bitcoin goes down one or

two perc we go down three or 4 perc um so it works on both sides of the equation but essentially holding Bitcoin makes us um a much stronger company uh and it allows us a lot of flexibility because it's essentially a way to hold our cash in an asset that appreciates better than treasuries better than stocks equities uh and anything else and it's a commodity we understand very well um and so it's a commodity that's also finite this is the reason why we believe many companies should be holding you

know two to three% of their Assets in Bitcoin on their balance sheet because from a uh risk adjusted perspective uh it has a huge impact on your returns uh to the positive so um if you then go to the convert um you know in challenging times like this industry saw in 2022 having the overhang of the convert uh you know having nearly $800 million of debt on a company whose um Market dropped significantly under a billion dollars was quite risky and we believe that we want to be resilient as a company and so we believed it was

prudent to essentially take down uh and convert that debt such that our balance sheet became much stronger and uh it is very much stronger today as you look at the balance of that convert you know in interest rate environment where it's now five plus percent that convert is at 1% interest with no amortization and it essentially terminates at the end of 2026 so we have a little over two and a half years left of Life on that and again we look at kind of what's the irr in our Capital should we spend more

Capital today to pay that down or should we continue to invest in growth uh items and as we look at the Delta between the price of the bonds and the par value of the bonds uh the discount has shrunk considerably as our stock has moved up in price and as Bitcoin has moved up in price so the attractiveness uh of converting that uh in advance of its uh expiration has reduced quite a lot uh you know when we did the conversion uh last year um we essentially saved our shareholders about $111 million uh versus waiting to maturity so

uh significant amount of money so we'll see we keep tracking we keep looking at it and you know there may or may not be opportunities in the future for us to do something with it but great question okay got it got it and then I know you recently acquired two hosting sites from from generate Capital could you maybe talk about the details around those transactions and maybe also a little bit about the 200 megawatt wind powerered site from apply digital sure so um Marathon grew kind of to its current size through a strategy called

asset light so in our industry there are three constraints and they all start with the letter c Capital you have to have access to Capital very Capital intensive business capacity which is essentially places you can put your mining equipment so data centers uh and then compute which are the computers themselves if you would and so we had easy access to Capital in 2020 2021 we had easy access to compute but we didn't have um if you looked at the ability of building and owning your own capacity there's a

long lead time it's 18 to 24 months or more and so we decided we would work with third-party hosting companies essentially uh kind of like using um thirdparty data center operators and we rented space uh paid for power paid for them to operate the miners and that allowed us to put 100% of our capex into just buying computers mining rigs essentially and deploying them and not spending any money on infrastructure or data centers and historically data center infrastructure represents about 30 to 40% of your overall capex

investment and so it allowed us to given a billion dollars of capital grow that much faster than our peers who were investing in infrastructure now along comes uh the end of 20123 and with the upcoming having we realized a lot of these thirdparty host data centers uh we're going to start losing value because these businesses were not going to be sustainable post the having where the amount of Bitcoin produced um uh per block was going to be chopped by 50% and so the profits of those companies would drop they would

become unprofitable and potentially go out of business and so up until December of last year we owned only 3% of our infrastructure uh through the three trans actions that we did the two generate um sites and the applied site we went from 3% owned to 54% Owned at a lower cost than it would have cost us to build them so the agile strategy the asset light strategy paid off very effectively it allowed us to grow to be the biggest and it also allowed us to acquire over 50% of the infrastructure where we operate um at a discount essentially to

build it more important there was excess capacity at those sites that we didn't use other people were hosted in those sites and by essentially terminating the contracts for the other third parties that were hosted we acquired an additional almost 300 U megawatts of capacity which allows us to grow even faster as a company because now we don't have to go build those sites we just essentially can plug more miners in and so we're in the process right now of transitioning out those customers from the sites and plugging

our own miners in which is one of the reasons why we can grow to 50x aash this year and why we raised our growth targets so substantially uh because we had the capacity available and so today we now have 1.1 gwatt of power under our control maybe it's one of the biggest uh infrastructure owners as well and we'll continue to grow the ownership piece of the capacity that uh we own the percentage owned versus third party such that most probably by the end of this year we'll be somewhere closer to 80% while we're doubling in size from

where we were at the end of last year so uh all very exciting um and you know if you've been kind of following the news you'd see we uh have done something that um no other Bitcoin miner has done before or you know uh even Energy company really is that we just signed a memorandum of understanding with the government of Kenya to essentially evaluate all of the underutilized energy assets that they have and see how those could be monetized using um digital acid compute and also potentially some Ai and

work with them to really uh leverage Bitcoin mining as a way to not only generate revenues for energy that otherwise they were not generating revenues on but also um you know Kenya is a unique country this is the country that invented something called impesa which was actually one of the first first um digital uh currency systems that um found broad adoption there are tens of millions of people in Africa that use the impesa system still to this day and it's based on cell phone credits and so you had essentially um people in

Kenya who were doing business with each other by trading cell phone credits instead of money and today uh there are uh over 10 million people in Kenya that use the impesa system and uh it's now available I think in 14 countries in Africa and we believe u as does the Kenan government that Bitcoin has the potential to kind of do what impesa has done only on steroids and so we're working with the government to uh really look at how they can leverage digital asset compute to not only generate Revenue but also increase Financial

Independence and help people um you know essentially do more business which then grows GDP which increases prosperity and you know one of the interesting things is when we go into a developing country and build sites we bring with us technology internet access for example we need internet access so we have to develop internet access in the country so we bring a lot of very positive things for the communities that we operate in um as well as you know tax revenues and other things so that I think that really sets us apart from

other um Bitcoin mining companies which tend to be uh more kind of taking advantage of the grid we're actually helping countries and helping communities do things in a very positive way right okay and then so you you talked about more acquisition it sounds like or sites um is that 80% is that the a level that you would is at an optimal level with still having some Outsourcing or is 100% more optimal with the you know with the how H having coming yeah well the having has come and gone uh so it happened in April sorry sorry yeah

yeah there'll be another one in in 2028 and so we're always looking you know somewhere between four to 10 years down the road and so we are going to continue to focus on developing our energy harvesting business where we have essentially near zero cost energy such that we become um impervious to these having events uh over time and generate revenues from things associated to energy and digital acid compute and the combination thereof as well as heat recycling um but more importantly I think as we continue to build out the

energy harvesting sites and more of these um large utility scale sites uh the third-party owned sites will essentially be diluted down to a DI Minimus portion but um I think it's still going to take a couple of years for us to get to the 100% Point um there are some sites that we operate at for third party perspective that are very VI viable as third party sites and you know we'll continue to operate there as long as makes sense uh we're also um doing a lot of things via joint ventures in the international markets

which you know the market will learn more about as we make the announcements over the course of this year um and uh essentially there uh similar to what we've done in UAE which is a joint venture with the Sovereign there uh you could almost say we're host at that site though we own uh a portion of the site um it is an independent company that operates and uh you know our miners are hosted there and we pay for that so uh there will always be a portion of third party hosted in what we do because of the nature of those

JBS okay and we had another question come in from our audience here is how do you see your landfill gas business expanding so landfill gas is a very um interesting business because um in the landfill gas uh mitigation World a portion of the gas uh is able to be sold and injected into natural gas pipelines and so these are landfills that sit adjacent to uh natural gas pipelines uh a portion of the gas is used for energy generation where that energy can be connected to the grid and then there's kind of what's left over uh

and what's left over tend to be small sites so over time uh uh there's an opportunity to get multiple hundreds of megawatts of power that way but each individual site could be from one megawatt to five 10 megawatts possibly and so it's a kind of business where uh you accumulate over time lots and lots of these sites uh the best thing about them is that um if you ever wanted to just not mine Bitcoin you could always just sell the electricity and so uh we view them as very um investment worthy assets the best part of it though is

that you know essentially it lowers our cost to mind Bitcoin significantly um in the short term and uh you know they uh continue to operate for the long term and because our cost to mine is so low at these sites it allows us to extract even longer useful life out of the equipment we put at the site got it okay okay that makes a good good amount of sense and then I guess we've talked about a lot of this so far but maybe if we could kind of uh pull it all together here could you talk about the Strategic Partnerships you have the

collaborations and how they all contribute to the company's growth and and development sure so um take UAE for example um we started working with the Sovereign in UAE to help them leverage Bitcoin mining as a way to balance their grid uh they had done some earlier Pilots with different companies and not had necessarily great success we came in design find uh a site a test site using uh our full immersion technology our singlephase technology and uh the pilot site Ran So successfully they decided to pick us as

their partner uh and so we put together a deal to build a a combination of two sites totaling 250 megawatts roughly um in Abu Davi uh one of which is in the middle of population center it's quite interesting to see this field of containers in the middle of a City being developed around it right um and they help um balance the load across the UAE on the electrical grid and uh those machines have amazing uptime I think it's in a 99.

x% uptime which uh is just fabulous considering the harsh environmental conditions you know the climate there is temperatures are over 100 degrees Fahrenheit um and you know humidity is 95% plus so um that was a great Testament to our technology capability really and um was kind of the basis for all of the technology we're beginning to deploy relative to liquid cooling going forward across our systems um you know the government in Kenya I just mentioned so that's a strategic partnership there uh we have strategic Partnerships with companies in the uh

landfill energy generation uh space um and you'll see more of those announcements uh coming soon uh you're going to see us announcing Partnerships around uh the heat Recycling and heat reuse uh you'll also see Partnerships announced around um things like um how to leverage agricultural waste and generate energy from it so uh you know we will begin to build a kind of network of Partnerships which uh will be enabling Partnerships and provide kind of a uh extended reach for Marathon that will enable us to really grow in all of

these different areas um at an accelerated rate versus us doing it all ourselves right well uh Fred last question from from me and and then I'll let you get back to you know your your your day job uh here but uh uh what are some of the key milestones and goals that we should be watching over the next 12 and in 24 months uh for the company well um our utility scale mining business uh you know we're targeting 50x a hash which would be roughly 2x what we did last year from a capacity perspective uh so I

think uh you'll see that as something to watch out for uh you'll see us become uh more optimized in our cost to produce Bitcoin um here post having and then you'll start seeing initial successes uh and Pilots around our energy harvesting business and our technology business as we begin uh selling technology components to third parties and I think those are going to be the proof points to our uh diversification strategy and then uh we have some other exciting things kind of in the hopper that I think uh the market will enjoy very much

which all will go to essentially contributing to a more Diversified business and when you take uh you know Diversified revenue streams that aren't as volatile as potentially bitcoin price are or aren't dependent on bitcoin price um you get a business that uh you know can still have very Dynamic growth in um the upswings in the market but doesn't suffer uh the dynamic downturns of the market because it's more um resilient to that right we're this has been great uh thanks for spending time with us today

is there anything you want to leave our audience with before uh let you go I know it told you 45 minutes and we're right at 45 minutes so I don't want to waste any more of your time but anything else you want to leave us with you know I think we're really excited about interacting with uh investors uh you know institutional inv s and and Retail investors and really getting feedback on uh you know what uh they think we're doing right what they think we could do better what types of information would

they like to see us uh talking more we obviously have lots and lots of stuff going on we don't necessarily always talk about it with the public uh but we're very open to interacting uh with all of our investors and uh being a company that doesn't uh have traditional customers like many companies do we view our investors really as our customers and so we love the interaction that's great well Fred thanks so much today we look forward to watching your continued success and we'll be in touch

soon great look forward to it thank you very much absolutely take care